|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Modular Home Mortgage Companies: A Comprehensive GuideModular homes have become a popular choice for many homebuyers due to their affordability and customizable features. However, financing these homes requires an understanding of the specific mortgage options available through modular home mortgage companies. This guide explores the essentials of securing a mortgage for a modular home and addresses common concerns. What Are Modular Homes?Modular homes are prefabricated buildings, constructed in sections or modules in a factory setting, and then transported to the site for assembly. Unlike manufactured homes, modular homes are built to local building codes and offer a wide range of design possibilities. Benefits of Modular Homes

Financing a Modular HomeWhen it comes to financing, modular home mortgages differ slightly from traditional mortgages. It’s important to choose a lender experienced in modular home financing. Types of Loans AvailableModular home buyers can typically access the same types of loans as traditional home buyers, such as:

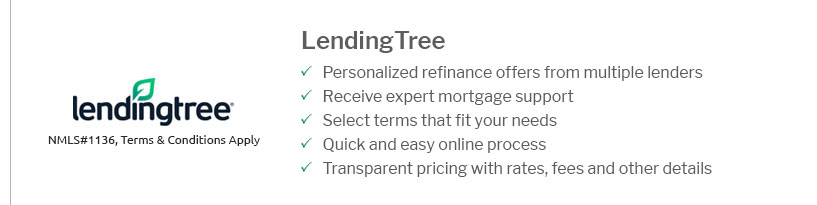

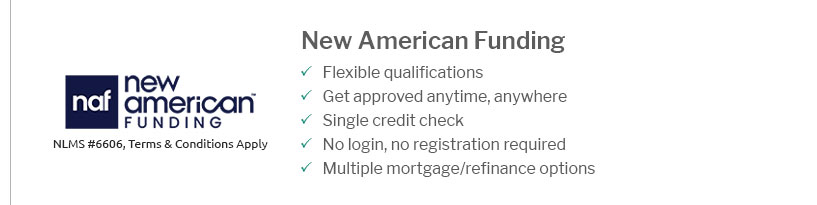

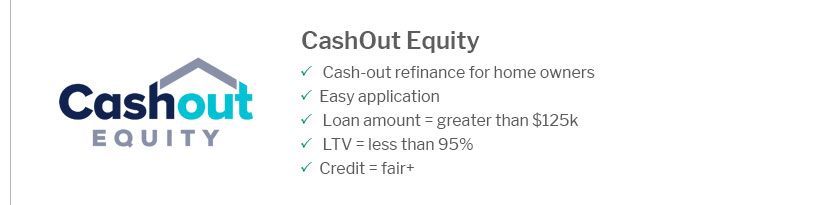

Utilizing a mortgage lender search can help identify suitable lenders who specialize in modular home financing. Challenges in Securing a Modular Home MortgageDespite the benefits, potential homebuyers may face challenges when securing a mortgage for a modular home. Common issues include:

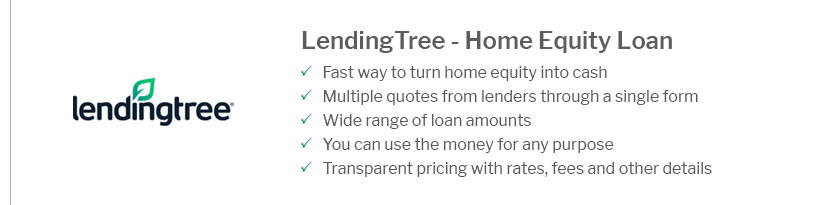

Frequently Asked QuestionsWhat is the difference between a modular home and a manufactured home?Modular homes are built to local building codes and offer more design flexibility, while manufactured homes are built to HUD standards and are generally less customizable. Can I refinance a modular home mortgage?Yes, refinancing options are available for modular home mortgages. Consider looking into a 15 year refinance to potentially lower your interest rates and shorten your loan term. Are modular home loans more expensive?Not necessarily. The cost of a modular home loan can be comparable to a traditional home loan, but it largely depends on the lender and the borrower's credit profile. Understanding these key points can help you navigate the process of securing a mortgage for your modular home, ensuring that you make informed decisions and choose the best financing options available. https://crosscountrymortgage.com/mortgage/resources/manufactured-mobile-home-financing/

Manufactured home and mobile home financing options - Conventional loans - VA loans - FHA loans - Chattel loans for mobile home financing - Personal ... https://www.guildmortgage.com/mortgage-loans/manufactured-home-loan/

We offer a variety of manufactured home loans to best suit your unique homebuying situation. As a less expensive route to homeownership, manufactured homes ... https://www.elend.com/modular-home-financing/

eLEND is pleased to offer home financing assistance to borrowers interested in purchasing or refinancing modular built homes throughout much of the United ...

|

|---|